The Importance of Maternity Insurance for Twins Why Specialized Coverage Matters

Discover why maternity insurance for twins is crucial for covering specialized medical needs, ensuring comprehensive care, and easing financial burdens during a high-risk pregnancy.

Pregnancy is a transformative experience, but when carrying twins, the stakes are even higher. Maternity insurance for twins is crucial to address the unique challenges that come with a multiple pregnancy. This blog post will explore why specialized maternity insurance coverage is essential, what to look for in a policy, and tips for finding the best plans. We’ll cover everything from maternity health insurance options to tips for navigating maternity insurance for high-risk pregnancies.

Why Specialized Maternity Insurance for Twins is Crucial

Unique Challenges of a Twin Pregnancy

Pregnancy with twins, or higher-order multiples, presents several unique challenges

-

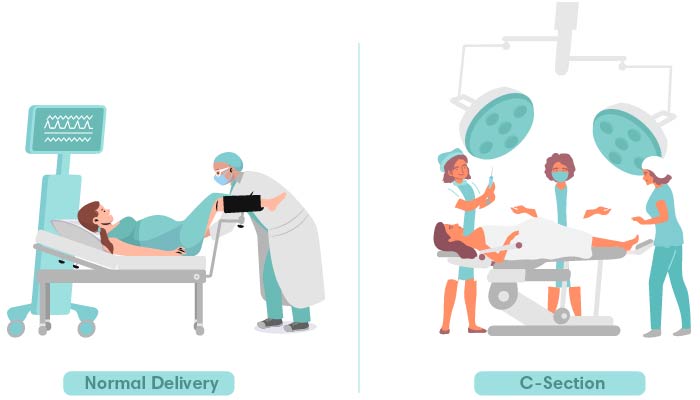

Increased Medical Risks Twin pregnancies often carry a higher risk of complications such as preterm labor, gestational diabetes, and preeclampsia. The likelihood of requiring a cesarean section is also higher. Maternity insurance for twins helps manage these risks by providing coverage for specialized care and potential complications.

-

Higher Medical Costs The cost of prenatal care, delivery, and postnatal care for twins can be significantly higher than for a singleton pregnancy. Comprehensive maternity insurance ensures that you are protected against these increased costs, including hospital stays, additional ultrasounds, and neonatal care.

-

Specialized Care Needs Twins often require more frequent monitoring and care from specialists. Maternity insurance for twins should cover visits to high-risk obstetricians and other specialists to ensure the health and safety of both mother and babies.

Why You Need Specialized Insurance Coverage

While general pregnancy insurance options might cover standard maternity expenses, they may not offer adequate support for the unique needs of a twin pregnancy. Specialized maternity insurance coverage provides

- Extended Coverage for Prenatal Care Increased number of doctor visits, ultrasounds, and tests.

- Higher Benefit Limits To accommodate the extra medical expenses associated with twins.

- Coverage for High-Risk Deliveries Ensures that complications such as preterm birth or cesarean sections are covered.

What to Look for in a Maternity Insurance Policy

Choosing the right maternity health insurance policy for a twin pregnancy involves considering several key factors

Coverage Options

-

Comprehensive Maternity Insurance Look for plans that offer extensive coverage including prenatal visits, hospital stays, and postnatal care. Comprehensive maternity insurance is essential to manage the additional costs associated with a twin pregnancy.

-

High-Deductible Maternity Insurance Some plans come with higher deductibles but lower premiums. If you expect high medical costs, ensure that the plan still provides adequate coverage despite the higher deductible.

-

Maternity Insurance with Low Premiums Balance the cost of premiums with the level of coverage. While lower premiums are appealing, ensure they don’t compromise essential coverage.

-

Maternity Insurance without Waiting Period Look for policies that offer coverage without long waiting periods. This is crucial if you’re already pregnant or planning to conceive soon.

Types of Policies

-

Private Maternity Insurance Offers more flexibility and comprehensive coverage than some group plans. Ideal for those seeking personalized care and additional benefits.

-

Employer-Sponsored Maternity Insurance Check if your employer offers employer maternity insurance benefits as part of a group plan. These plans often provide good coverage but may have limitations.

-

International Maternity Insurance If you’re traveling or living abroad, international maternity insurance ensures you have access to adequate care in different countries.

-

Short-Term Maternity Insurance For those needing temporary coverage, this can be a viable option but may not offer all the benefits of long-term plans.

Additional Considerations

-

Maternity Insurance Benefits Evaluate what benefits are included, such as coverage for high-risk pregnancies, prenatal vitamins, and lactation support.

-

Maternity Insurance for Self-Employed or Freelancers If you’re self-employed or a freelancer, find policies tailored for your employment status. These plans often cater to the unique needs of independent workers.

-

Family Maternity Insurance Plans Consider plans that offer coverage for the entire family, which can be cost-effective and convenient.

-

Maternity Insurance Tax Benefits Some plans offer tax advantages. Look into potential tax benefits associated with maternity insurance to maximize savings.

Tips for Finding the Best Maternity Insurance Plans

-

Compare Policies Use online tools to perform a maternity insurance comparison. This will help you identify the best plans for your needs and budget.

-

Get Online Quotes Obtain online maternity insurance quotes from various providers to compare coverage options and costs efficiently.

-

Check for Enrollment Periods Ensure you are aware of the maternity insurance enrollment period to avoid gaps in coverage.

-

Read the Fine Print Understand the maternity insurance renewal terms and any exclusions or limitations in the policy.

-

Consult an Expert Speak with a health insurance advisor or broker who specializes in maternity insurance to get personalized recommendations.

Common Maternity Insurance Coverage Options

-

Prenatal Insurance Policies Covers all prenatal care including visits to specialists and routine check-ups.

-

Coverage for Cesarean Sections Ensures that costs associated with cesarean sections are included.

-

Maternity Insurance for High-Risk Pregnancies Offers additional support and coverage for pregnancies deemed high-risk.

-

Family Maternity Insurance Plans Provides comprehensive coverage for the entire family, including newborns.

-

Affordable Maternity Insurance Balances cost with necessary coverage, ensuring you get the best value for your money.

Choosing the right maternity insurance for twins is crucial for managing the unique challenges associated with a multiple pregnancy. By considering specialized coverage options and thoroughly comparing policies, you can find a plan that offers the protection and support needed for a healthy pregnancy and delivery. Whether you're in Louisville, Grand Rapids, Oklahoma City, Lansing, or Des Moines, make sure to explore all available options to find the best maternity health insurance plan for your needs.

Comprehensive Guide to Maternity Insurance for Twins Comparing Policies and Choosing the Right Coverage

Expecting twins comes with unique challenges and additional expenses, making the choice of maternity insurance for twins a crucial decision. In this guide, we’ll compare various maternity insurance providers and their offerings, focusing on coverage limits, costs, and benefits specific to twin pregnancies. We aim to help you understand how to select the best policy to fit your needs.

Understanding Maternity Insurance for Twins

When you’re expecting twins, your healthcare needs are more complex, and so are your insurance requirements. Maternity insurance coverage for twins should adequately address the increased medical costs and potential complications associated with a multiple pregnancy. Here’s what to look for

Key Features of Maternity Insurance for Twins

-

Coverage Limits Policies with higher coverage limits are essential as twin pregnancies typically involve more prenatal visits, ultrasounds, and potentially a cesarean section.

-

Costs Consider both the premiums and out-of-pocket costs, such as deductibles and co-pays. Policies with low premiums may be attractive but ensure they offer comprehensive coverage.

-

Benefits Look for policies offering benefits like prenatal care, hospital stays, and newborn care. Some policies might include additional perks, such as lactation consultation and postpartum support.

Comparing Maternity Insurance Providers

Here’s a comparison of some top providers for maternity insurance for twins, focusing on their coverage limits, costs, and specific benefits.

1. Blue Cross Blue Shield (BCBS)

-

Coverage Limits BCBS offers high coverage limits for comprehensive maternity insurance, including prenatal and postnatal care. They also cover hospital stays and procedures such as cesarean sections.

-

Costs Premiums can vary significantly based on the plan, but BCBS often provides options for affordable maternity insurance. They have plans with both high and low deductibles to suit different budgets.

-

Benefits Includes maternity health insurance with benefits for twin pregnancies, such as additional ultrasounds and specialist visits. They also offer support for high-risk pregnancies.

2. UnitedHealthcare

-

Coverage Limits Known for robust maternity insurance plans, UnitedHealthcare provides extensive coverage for prenatal visits, hospital delivery, and postnatal care. Their plans include maternity insurance for high-risk pregnancies.

-

Costs Offers both high-deductible maternity insurance and plans with lower premiums. UnitedHealthcare also provides options for private maternity insurance, which can be beneficial for those seeking more personalized care.

-

Benefits Includes access to a wide network of specialists and facilities. They also offer maternity insurance without waiting period in some cases, which is ideal for immediate coverage.

3. Kaiser Permanente

-

Coverage Limits Kaiser Permanente provides comprehensive coverage for twin pregnancies, including extensive prenatal care and hospital delivery. Their policies are well-suited for those seeking comprehensive maternity insurance.

-

Costs Generally, Kaiser offers affordable maternity insurance with competitive premiums and reasonable out-of-pocket costs. They have options for both group maternity insurance plans and individual coverage.

-

Benefits Includes robust prenatal and postnatal care, including access to maternity classes and support services. They also offer maternity insurance benefits that cater specifically to the needs of expecting twins.

4. Humana

-

Coverage Limits Humana’s maternity health insurance plans include high coverage limits for multiple births. Their policies often cover a wide range of prenatal and postnatal services.

-

Costs Humana provides options for maternity insurance with low premiums and high-deductible maternity insurance. They offer flexibility in terms of premium costs and deductible levels.

-

Benefits Humana includes benefits for maternity insurance for freelancers and self-employed individuals. They also offer coverage for maternity insurance for cesarean section and other specialized needs.

5. Aetna

-

Coverage Limits Aetna provides high coverage limits for family maternity insurance plans, making it a good option for twins. Their plans include comprehensive coverage for prenatal, delivery, and postnatal care.

-

Costs Offers competitive pricing with options for both low and high-deductible plans. Aetna is known for providing affordable maternity insurance with various deductible options.

-

Benefits Includes benefits tailored to the needs of multiple pregnancies and access to a wide network of healthcare providers. They also offer maternity insurance for unmarried mothers and maternity insurance for adoption.

Choosing the Right Policy

When selecting the best maternity insurance plan for twins, consider the following factors

Coverage Needs

Ensure the policy covers all aspects of a twin pregnancy, including

- Prenatal visits and ultrasounds.

- Hospital delivery and potential cesarean section.

- Postnatal care for both mother and babies.

Cost Considerations

Evaluate both premiums and out-of-pocket costs. Policies with low premiums might be appealing, but ensure they provide adequate coverage. Compare maternity insurance quotes online to find the best deals.

Additional Benefits

Look for policies offering additional benefits such as

- Prenatal classes and lactation consultation.

- Postpartum support and mental health services.

- Tax benefits related to maternity insurance.

Enrollment and Renewal

Consider the maternity insurance enrollment period and renewal terms. Some policies might have specific enrollment windows or conditions for renewal.

Choosing the right maternity insurance for twins involves balancing coverage limits, costs, and benefits. By comparing top providers such as Blue Cross Blue Shield, UnitedHealthcare, Kaiser Permanente, Humana, and Aetna, you can find a plan that meets your needs and offers the best support for your twin pregnancy. Ensure you consider factors like coverage limits, costs, and additional benefits to make an informed decision. For those in cities like Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines, exploring local options and getting online maternity insurance quotes can also help in finding the best plan for your situation.

A Comprehensive Guide to Applying for Maternity Insurance for Twins

Expecting twins brings an extra layer of excitement—and complexity—to your maternity journey. Ensuring you have the right maternity insurance coverage is crucial to manage the costs associated with multiple births. This guide provides a step-by-step approach to applying for maternity insurance for twins, covering the application process, necessary documentation, and additional considerations.

Step 1 Understand Your Maternity Insurance Needs

Before applying for maternity insurance, it's important to assess your needs. For twins, you'll require comprehensive maternity insurance that covers additional expenses compared to a singleton pregnancy. Key aspects to consider include

- High-deductible maternity insurance vs. low-premium maternity insurance

- Maternity insurance for high-risk pregnancies if applicable

- Prenatal insurance policies and coverage for multiple ultrasounds and specialized care

Step 2 Research and Compare Maternity Insurance Plans

Start by researching best maternity insurance plans available. Compare different options to find a policy that meets your needs

- Maternity insurance comparison websites can be helpful

- Look for affordable maternity insurance that doesn’t compromise on coverage

- Consider private maternity insurance options for more personalized care

When comparing plans, check for

- Coverage for cesarean sections

- Benefits related to maternity health insurance

- Coverage for multiple births and potential complications

Step 3 Gather Necessary Documentation

Once you’ve chosen a plan, you’ll need to provide specific documentation to apply for maternity insurance. Generally, this includes

- Proof of pregnancy, such as a pregnancy confirmation letter from your healthcare provider

- Details about your current health insurance (if applicable)

- Income verification if applying for maternity insurance for self-employed or freelancers

- Any relevant medical records, especially if you have a high-risk pregnancy

Step 4 Complete the Application

With your documentation in hand, follow these steps to complete the application process

-

Fill Out the Application Form Most insurers provide an online application form, but you can also apply by phone or in-person.

-

Submit Required Documentation Upload or send the required documents as instructed by the insurer.

-

Review and Confirm Double-check all information and ensure that it’s accurate before submission. Errors or omissions can delay your application.

-

Pay Premiums Depending on the plan, you may need to pay an initial premium. Some plans offer short-term maternity insurance with varying payment structures.

Step 5 Wait for Approval

After submitting your application, the insurer will review it and decide on approval. This process may vary in length, but you can usually expect to receive a decision within a few weeks. During this time, the insurer might request additional information or clarification.

Step 6 Review Your Policy

Once approved, carefully review your maternity insurance policy

- Check the coverage details, including what’s included for a multiple birth.

- Understand the maternity insurance benefits and any waiting periods that might apply.

- Note the enrollment period and renewal terms.

Additional Considerations

Employer-Sponsored vs. Private Insurance

If you’re employed, check if your employer offers employer-sponsored maternity insurance. This might be more cost-effective compared to private maternity insurance. However, private plans can offer more comprehensive coverage.

Maternity Insurance for Unmarried Mothers

If applicable, explore maternity insurance for unmarried mothers. Many policies do not discriminate based on marital status, but it’s essential to confirm.

International Coverage

If you’re planning to travel or live abroad, look into international maternity insurance options. This ensures you’re covered regardless of location.

Tax Benefits

Explore maternity insurance tax benefits. Certain plans may offer tax advantages, which can help offset some of the costs.

Applying for maternity insurance for twins involves careful planning and research. By understanding your needs, comparing different plans, and ensuring you provide the necessary documentation, you can secure the coverage that best supports your pregnancy journey. Whether you choose affordable maternity insurance, group maternity insurance plans, or a high-deductible maternity insurance option, the right policy will help ensure a smooth and financially manageable pregnancy.

Top Tips for Finding Affordable Maternity Insurance for Twins

When expecting twins, securing the right maternity insurance coverage is crucial to managing the costs of your pregnancy. Navigating the world of maternity health insurance can be daunting, but with the right strategies, you can find a plan that offers comprehensive coverage while being mindful of your budget. Here’s a guide to help you find the best maternity insurance for twins, maximize your benefits, and reduce out-of-pocket expenses.

1. Understand Your Maternity Insurance Options

Before diving into specific plans, familiarize yourself with the different types of pregnancy insurance options available

- Private maternity insurance These plans are purchased individually and often offer more flexibility in coverage options compared to group plans.

- Employer-sponsored maternity insurance Offered through your workplace, these plans might come with better coverage and lower premiums.

- Group maternity insurance plans These are often provided through unions or associations and can offer competitive rates.

- International maternity insurance Ideal for those living abroad or planning to deliver outside the USA.

2. Compare Policies to Find the Best Coverage

When comparing maternity insurance for twins, look for the following

- Comprehensive maternity insurance Ensure the plan covers a wide range of prenatal care, delivery, and postnatal care.

- Maternity insurance without waiting period Choose a plan that does not have a waiting period or has a minimal waiting period to start covering your pregnancy-related expenses.

- Maternity insurance for high-risk pregnancies If you’re expecting twins, you may be classified as high-risk. Ensure the policy covers additional needs and specialist consultations.

- Maternity insurance for cesarean section Verify that the policy covers the costs of a cesarean delivery if necessary.

Use online tools to obtain online maternity insurance quotes and compare them side-by-side. Pay attention to coverage limits, exclusions, and out-of-pocket costs.

3. Maximize Your Coverage Benefits

To get the most out of your maternity insurance benefits

- Choose the right deductible Balance your deductible with your monthly premiums. A higher deductible might lower your premiums, but ensure you can afford the out-of-pocket costs.

- Look for additional perks Some plans offer added benefits like free prenatal classes or lactation consultations.

- Consider family maternity insurance plans If you already have a family plan, check if adding maternity coverage for twins can be more cost-effective than individual policies.

4. Strategies for Reducing Out-of-Pocket Expenses

Reducing out-of-pocket costs is key during a twin pregnancy

- Explore tax benefits Look into maternity insurance tax benefits that might be available to you.

- Check for subsidies and financial aid Some states or insurance programs offer financial assistance for maternity insurance for self-employed individuals or those with low income.

- Negotiate with your healthcare provider Sometimes, providers can offer discounts or payment plans if you discuss your financial situation upfront.

5. Evaluate Short-Term and Long-Term Policies

Depending on your situation, you might need to choose between

- Short-term maternity insurance Ideal for temporary coverage, especially if you’re between jobs or waiting for a more permanent solution.

- Long-term plans Consider a comprehensive maternity insurance plan that covers not just your current pregnancy but future needs as well.

6. Review Enrollment Periods and Renewal Terms

Make sure you are aware of

- Maternity insurance enrollment period Open enrollment periods can affect when you can sign up for a new plan or make changes to your existing coverage.

- Maternity insurance renewal terms Ensure that your plan’s renewal terms are favorable and that you won’t face significant rate increases in the future.

7. Consider Specialized Coverage for Unique Needs

For specific scenarios

- Maternity insurance for freelancers Look for plans designed for freelancers that provide adequate maternity coverage.

- Affordable maternity insurance Find plans with low premiums that still offer good coverage for twins.

- High-deductible maternity insurance If you opt for a high-deductible plan, ensure you have a health savings account (HSA) or flexible spending account (FSA) to cover additional expenses.

8. Utilize Resources and Professional Advice

- Seek professional advice Consult with an insurance broker who specializes in maternity health insurance to guide you through your options.

- Research online Use resources and reviews to find the best maternity insurance plans and understand other families' experiences.

By following these tips, you can find the best maternity insurance for twins that meets your needs and budget, ensuring a smoother and more affordable pregnancy journey. Whether you are in Louisville, Grand Rapids, Oklahoma City, Lansing, or Des Moines, these strategies will help you navigate the insurance landscape and make informed decisions about your maternity coverage.

Understanding Maternity Insurance for Twins Common Questions Answered

Pregnancy is a joyous occasion, but when expecting twins, the journey can come with additional considerations, particularly regarding maternity insurance for twins. Understanding what your insurance covers and addressing common concerns can make a significant difference in your planning and peace of mind. In this article, we’ll address frequently asked questions and misconceptions about maternity insurance coverage, focusing on key aspects such as prenatal care, delivery costs, and complications specific to twin pregnancies.

What Does Maternity Insurance for Twins Typically Cover?

When it comes to maternity insurance for twins, coverage can vary based on your plan. Here’s a breakdown of what you should expect

1. Prenatal Care

Prenatal care is crucial for monitoring the health of both the mother and the babies. Most maternity health insurance plans will cover

- Routine Check-ups Regular visits to your obstetrician for ultrasounds and blood tests.

- Specialist Consultations Additional consultations with specialists, if needed.

- Tests and Screenings Tests like amniocentesis or additional blood work that may be recommended for twin pregnancies.

However, it’s essential to confirm that your specific prenatal insurance policies include all necessary care and to verify the frequency of visits covered.

2. Delivery Costs

Delivery of twins generally involves higher costs than a singleton birth. Most comprehensive maternity insurance plans will cover

- Hospital Stay Costs for the mother and both babies, including any additional room or equipment needed.

- Labor and Delivery Coverage for both a vaginal delivery and a cesarean section, which is more common in twin pregnancies.

If you have a high-deductible maternity insurance plan, you may want to budget for out-of-pocket expenses.

3. Potential Complications

Twin pregnancies are often considered high-risk due to the increased likelihood of complications. Your maternity insurance for high-risk pregnancies should ideally cover

- NICU Costs If the twins need to be admitted to the Neonatal Intensive Care Unit (NICU).

- Extended Hospital Stays Any additional care required for complications.

Make sure to review your policy for coverage specifics and limitations related to complications.

Common Misconceptions About Maternity Insurance for Twins

1. It’s More Expensive and Unaffordable

While maternity insurance for twins can be more costly, especially if you are looking at private maternity insurance options, it doesn’t necessarily mean it’s unaffordable. There are various plans available, from affordable maternity insurance to group maternity insurance plans provided by employers. Comparing these options through online maternity insurance quotes can help you find a plan that fits your budget.

2. Coverage for Cesarean Sections is Limited

A common misconception is that maternity insurance for cesarean section is limited. In reality, many plans cover cesarean deliveries, especially if medically necessary. It’s important to review your maternity insurance benefits and ensure that any potential surgical deliveries are covered.

3. Prenatal Care Coverage is the Same Across All Plans

Not all prenatal insurance policies are created equal. Some may cover more extensive prenatal care or additional specialist visits, which can be vital for a twin pregnancy. Look into maternity insurance comparison tools to evaluate what’s included in each plan.

Key Considerations When Choosing Maternity Insurance for Twins

1. Enrollment Period

Timing is crucial. Ensure you understand your maternity insurance enrollment period and apply within the designated time frame. Some policies may have waiting periods or exclusions, so early planning is essential.

2. Insurance for Self-Employed and Freelancers

If you are self-employed or a freelancer, finding suitable maternity insurance for freelancers can be challenging. Look for maternity insurance for self-employed individuals that offer flexible terms and adequate coverage.

3. International Maternity Insurance

For those living abroad or planning international travel, international maternity insurance is crucial. Ensure it covers twin pregnancies and any additional healthcare needs while overseas.

4. Employer-Sponsored vs. Private Insurance

Employer-sponsored maternity insurance benefits may offer comprehensive coverage at a lower cost compared to private maternity insurance. Evaluate your options based on the employer maternity insurance benefits and any additional costs associated with private plans.

5. Coverage for Adoption

If considering adoption, check for maternity insurance for adoption. Some policies offer benefits for adopting twins, though this varies by plan.

6. Tax Benefits and Renewal Terms

Review any maternity insurance tax benefits that may apply to your situation. Additionally, be aware of maternity insurance renewal terms to avoid gaps in coverage.

Choosing the right maternity insurance for twins requires careful consideration of your coverage needs, potential costs, and policy specifics. From prenatal care to delivery and complications, understanding what’s covered can help you prepare financially and ensure that you and your babies receive the best care possible. By exploring various pregnancy insurance options and leveraging tools like maternity insurance comparison, you can find a plan that meets your needs and budget.

What's Your Reaction?