A Comprehensive Guide to Commercial Umbrella Liability Insurance for New Entrepreneurs

As a new entrepreneur, navigating the world of business insurance can be daunting. One crucial aspect to consider is Commercial Umbrella Liability Insurance. This type of insurance can provide additional coverage beyond the limits of your existing policies, offering an extra layer of protection against substantial claims. This guide will explore the key benefits of Commercial Umbrella Liability Insurance, debunk common misconceptions, and help you determine the right amount of coverage for various types of businesses. We’ll also address relevant terms like Professional Liability Insurance Quotes, General Liability Insurance for Small Business, and more.

What is Commercial Umbrella Liability Insurance?

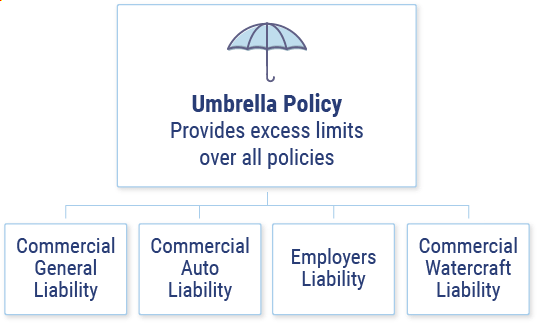

Commercial Umbrella Liability Insurance extends the coverage limits of your existing liability policies, such as General Liability Insurance and Commercial Auto Liability Insurance. It acts as a safety net, covering excess claims that surpass the limits of your primary insurance policies. For instance, if your General Liability Insurance policy has a limit of $1 million, but you face a claim of $1.5 million, your Commercial Umbrella Liability Insurance would cover the additional $500,000.

Key Benefits of Commercial Umbrella Liability Insurance

-

Enhanced Protection The primary benefit of Commercial Umbrella Liability Insurance is its ability to provide higher coverage limits. This means that in the event of a significant claim, your business is better protected against financial strain. This is especially crucial for businesses in high-risk industries or those with substantial assets.

-

Cost-Effective Coverage Purchasing an umbrella policy is often more affordable than increasing the limits on multiple individual policies. It provides broad coverage under a single policy, which can be a cost-effective solution for comprehensive protection.

-

Peace of Mind Knowing that your business has an additional layer of protection can provide peace of mind. This allows you to focus on growing your business without constantly worrying about potential liabilities that could exceed your standard coverage limits.

-

Broader Coverage Commercial Umbrella Liability Insurance can cover a range of liabilities not typically included in standard policies, such as Errors and Omissions Liability Insurance or Employment Practices Liability Insurance. This broader coverage can be particularly beneficial for businesses in industries like healthcare or consulting.

Common Misconceptions About Commercial Umbrella Liability Insurance

-

"It’s Only for Large Businesses" A common misconception is that Commercial Umbrella Liability Insurance is only necessary for large corporations. In reality, businesses of all sizes can benefit from the added protection, especially those with significant assets or high-risk exposures.

-

"It Covers Everything" While umbrella policies offer broad coverage, they do not cover all types of liabilities. For example, Commercial Umbrella Liability Insurance typically does not cover Professional Liability Insurance for specific professions, such as healthcare or legal services, which require specialized policies.

-

"It Replaces Other Insurance Policies" Some entrepreneurs believe that an umbrella policy can replace their existing liability policies. However, Commercial Umbrella Liability Insurance is designed to supplement, not replace, your primary insurance policies. It kicks in only after your primary coverage limits have been exhausted.

-

"It’s Only for High-Risk Businesses" While high-risk businesses certainly benefit from Commercial Umbrella Liability Insurance, even low-risk businesses can face substantial claims. The added protection can be a prudent choice for any business owner concerned about potential liabilities.

Determining the Right Amount of Coverage

Determining the appropriate amount of Commercial Umbrella Liability Insurance coverage depends on various factors, including the size of your business, industry, and potential risks. Here’s a step-by-step approach to help you determine the right amount

-

Assess Your Current Coverage Review your existing liability policies, such as General Liability Insurance for Small Business and Commercial Auto Liability Insurance. Understand the limits of each policy and identify any gaps in coverage.

-

Evaluate Your Risks Consider the nature of your business and potential risks. For example, a business involved in high-risk activities, such as construction or manufacturing, may require higher coverage limits compared to a consultancy or retail operation.

-

Analyze Your Assets Determine the value of your business assets and potential liabilities. Businesses with significant assets or those involved in high-stakes contracts may need higher coverage limits to protect against substantial claims.

-

Consult with an Insurance Professional Work with an insurance broker or agent who can help you assess your needs and recommend an appropriate amount of coverage. They can provide insights into industry-specific risks and help you tailor a policy that suits your business.

Types of Coverage to Consider

When selecting Commercial Umbrella Liability Insurance, it’s important to understand the different types of coverage it can extend

-

General Liability Insurance This covers common business risks such as bodily injury, property damage, and personal injury. An umbrella policy enhances these limits.

-

Professional Liability Insurance For businesses providing professional services, such as consultants or healthcare providers, this coverage protects against claims of negligence or errors.

-

Cyber Liability Insurance If your business handles sensitive customer data, this coverage protects against data breaches and cyber-attacks.

-

Product Liability Insurance For businesses that manufacture or sell products, this insurance covers claims related to product defects or safety issues.

-

Employer’s Liability Insurance This protects against claims related to employee injuries or illnesses not covered by workers' compensation.

-

Public Liability Insurance Useful for businesses that interact with the public, this coverage protects against claims of injury or damage occurring on your premises.

Choosing the Best Insurance Providers

When looking for the best General Liability Insurance Providers or Commercial Umbrella Liability Insurance, consider the following

-

Reputation Choose insurers with a strong track record of customer service and claims handling.

-

Coverage Options Ensure the insurer offers comprehensive coverage options that align with your business needs.

-

Cost Compare quotes from multiple providers to find a policy that offers the best value for your coverage needs.

-

Customer Reviews Look for feedback from other business owners to gauge the insurer’s reliability and service quality.

For new entrepreneurs, Commercial Umbrella Liability Insurance is a vital component of a comprehensive risk management strategy. It offers enhanced protection, cost-effective coverage, and peace of mind. By understanding the benefits, debunking common misconceptions, and determining the right amount of coverage, you can ensure that your business is well-protected against unforeseen liabilities.

Developing a Social Media Campaign Strategy for Promoting Commercial Umbrella Liability Insurance to Large Corporations

Introduction

In today’s complex business environment, large corporations face a multitude of risks. While standard insurance policies offer foundational protection, they may not cover every potential exposure. This is where Commercial Umbrella Liability Insurance comes into play. This additional layer of protection is crucial for mitigating risks that exceed the limits of primary liability policies. A well-crafted social media campaign can effectively communicate the importance of this coverage to large corporations. Below is a detailed strategy for promoting Commercial Umbrella Liability Insurance through social media platforms.

1. Define Campaign Objectives

Before launching your campaign, clearly define your objectives

- Increase Awareness Educate large corporations about the benefits of Commercial Umbrella Liability Insurance.

- Generate Leads Drive traffic to your website or landing pages where businesses can request quotes or more information.

- Establish Authority Position your company as a thought leader in risk management and insurance solutions.

2. Identify Target Audience

Focus on decision-makers within large corporations such as CFOs, Risk Managers, and Insurance Managers. Tailor your message to emphasize the importance of comprehensive coverage in safeguarding against unforeseen liabilities.

3. Key Messaging and Content Themes

a. The Importance of Additional Coverage

Highlight how Commercial Umbrella Liability Insurance offers extra protection beyond standard policies. Use real-world scenarios to illustrate potential gaps in coverage and how umbrella policies can bridge those gaps. Discuss

- General Liability Insurance for Small Business vs. Commercial Umbrella Liability Insurance Explain how an umbrella policy extends beyond typical coverage limits.

- Professional Liability Insurance Quotes Show how umbrella insurance complements other liability policies like Professional Liability Insurance for Consultants and Public Liability Insurance for Contractors.

b. Risk Mitigation

Emphasize how Commercial Umbrella Liability Insurance helps manage high-risk situations and mitigates the impact of costly claims. Discuss

- Cyber Liability Insurance Coverage and how umbrella policies provide additional coverage for cyber incidents.

- Product Liability Insurance Cost and the financial protection an umbrella policy offers in case of product-related claims.

c. Cost vs. Benefit Analysis

Illustrate the cost-effectiveness of investing in an umbrella policy compared to potential financial losses from major claims. Use examples of

- Errors and Omissions Liability Insurance Compare the cost of an umbrella policy with potential out-of-pocket expenses without one.

- Commercial Liability Insurance for Contractors Demonstrate the added protection an umbrella policy provides to cover higher exposure levels.

4. Content Ideas for Posts and Ads

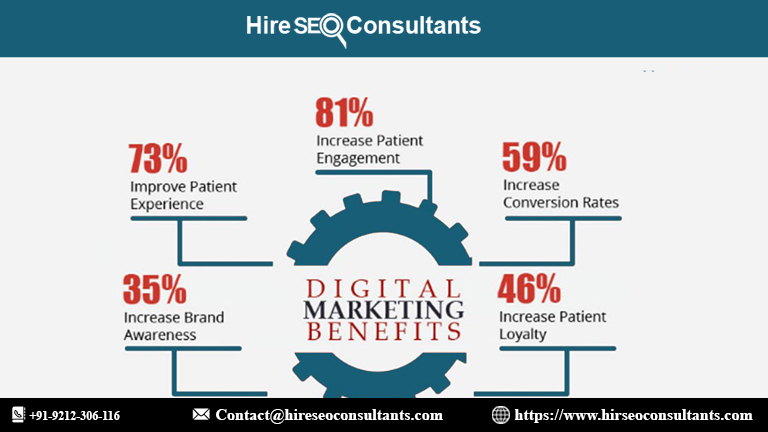

a. Educational Infographics

Create visually engaging infographics that outline

- The key differences between Commercial Umbrella Liability Insurance and other types of coverage.

- How an umbrella policy enhances existing insurance, including Employer’s Liability Insurance Policy and Public Liability Insurance for Freelancers.

b. Case Studies and Success Stories

Share real-life examples or case studies showcasing how Commercial Umbrella Liability Insurance helped large corporations manage unexpected risks. Include

- Stories from businesses that faced significant claims and how umbrella coverage mitigated the financial impact.

- Testimonials from satisfied clients who experienced peace of mind with their comprehensive insurance coverage.

c. Interactive Content

Engage your audience with interactive content such as

- Quizzes to help businesses assess their need for Commercial Umbrella Liability Insurance.

- Polls asking about their current coverage and gaps they may be concerned about.

d. Expert Opinions and Interviews

Feature interviews or guest posts from industry experts discussing

- The importance of Commercial Umbrella Liability Insurance in the current risk landscape.

- Insights on Professional Liability Insurance for Healthcare Professionals and other specialized coverage areas.

e. Educational Videos and Webinars

Host webinars or create short educational videos covering

- An overview of Commercial Umbrella Liability Insurance and its benefits.

- Detailed explanations of various liability insurances like Cyber Liability Insurance for Small Business and Liquor Liability Insurance Coverage.

5. Platform-Specific Strategies

a. LinkedIn

Use LinkedIn to connect with business professionals and decision-makers. Share detailed articles, case studies, and whitepapers. Engage in industry groups and forums where you can discuss the benefits of Commercial Umbrella Liability Insurance.

b. Twitter

Post regular updates, tips, and infographics about umbrella insurance. Use hashtags such as #BusinessInsurance, #LiabilityCoverage, and #UmbrellaInsurance to reach a broader audience. Run Twitter polls or Q&A sessions to interact with followers.

c. Facebook

Create targeted ad campaigns and share educational posts that drive traffic to your website. Use Facebook Live to host discussions or interviews with insurance experts. Share success stories and client testimonials to build credibility.

d. Instagram

Leverage Instagram’s visual platform to share infographics, short video clips, and behind-the-scenes content. Use stories and reels to engage with your audience and provide quick, informative snippets about Commercial Umbrella Liability Insurance.

e. YouTube

Develop in-depth videos explaining the benefits of Commercial Umbrella Liability Insurance and its role in risk management. Create a series of educational videos that cover different aspects of business insurance and share them on your channel.

6. Measure and Optimize

Track the performance of your campaign using analytics tools. Monitor metrics such as

- Engagement rates (likes, shares, comments).

- Click-through rates to your website or landing pages.

- Conversion rates from leads to customers.

Use this data to adjust your strategy, optimize content, and refine targeting to better reach your audience.

7. Localize Content for Target Cities

When targeting specific cities like Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines, tailor your content to address local business needs and regulatory considerations. Highlight how Commercial Umbrella Liability Insurance can address unique risks in these regions.

A well-planned social media campaign promoting Commercial Umbrella Liability Insurance can effectively raise awareness and drive engagement among large corporations. By focusing on the importance of additional coverage, providing engaging content, and tailoring your strategy to specific platforms and locations, you can enhance your reach and impact. Implement these strategies to help businesses understand the value of comprehensive insurance and secure their operations against unforeseen risks.

Email Marketing Sequence for Insurance Brokers The Benefits of Offering Commercial Umbrella Liability Insurance

Email 1 Introduction to Commercial Umbrella Liability Insurance

Subject Elevate Your Client Offerings with Commercial Umbrella Liability Insurance

Body

Hi [Recipient's Name],

In today's dynamic business environment, Commercial Umbrella Liability Insurance is becoming an essential component of a comprehensive risk management strategy. As an insurance broker or agent, you have the opportunity to enhance your service offerings and protect your clients better by incorporating this crucial coverage.

What is Commercial Umbrella Liability Insurance?

Commercial Umbrella Liability Insurance extends beyond the limits of a business’s existing General Liability Insurance and Commercial Auto Liability Insurance policies. It provides an extra layer of protection against major claims that could otherwise jeopardize a business's financial stability.

Why Should You Offer It?

Here are a few compelling reasons why this insurance is beneficial

- Broadened Coverage It covers the gaps that might be left by primary policies like General Liability Insurance and Cyber Liability Insurance Coverage.

- Financial Protection It offers additional coverage limits, which can be crucial for handling large claims or lawsuits.

- Peace of Mind With this coverage, businesses can feel secure knowing they have a financial safety net for unexpected liabilities.

Next Steps

Incorporating Commercial Umbrella Liability Insurance into your offerings not only adds value to your service but also helps in building long-term client relationships.

Stay tuned for our next email, where we’ll dive deeper into tips for explaining the value of this coverage to your clients.

Best regards,

[Your Name]

[Your Contact Information]

[Your Company Name]

Email 2 Explaining the Value of Commercial Umbrella Liability Insurance

Subject How to Explain the Value of Commercial Umbrella Liability Insurance to Your Clients

Body

Hi [Recipient's Name],

In our previous email, we introduced the benefits of Commercial Umbrella Liability Insurance. Now, let’s focus on how you can effectively communicate its value to your clients.

1. Highlight the Gaps in Existing Coverage

Many businesses have policies like Professional Liability Insurance Quotes or General Liability Insurance for Small Business, but they might not realize these may not cover all potential risks. Emphasize how Commercial Umbrella Liability Insurance fills in these gaps, offering enhanced protection.

2. Use Real-Life Scenarios

Illustrate the importance of this coverage with real-life examples or case studies. For instance, a business with a substantial lawsuit could quickly exceed the limits of its primary insurance policies. Commercial Umbrella Liability Insurance would step in to cover the excess amount, preventing financial strain.

3. Stress the Cost-Effectiveness

While some might see Commercial Umbrella Liability Insurance as an additional expense, it's relatively affordable compared to the financial impact of a major liability claim. Show clients that investing in this insurance could save them significantly in the event of a large claim.

4. Emphasize Peace of Mind

Clients often value peace of mind. Explain how having Commercial Umbrella Liability Insurance ensures that they are better protected against unforeseen circumstances, allowing them to focus on running their business.

5. Offer a Comprehensive Comparison

Provide a comparison of Commercial Umbrella Liability Insurance with other types of liability coverage like Product Liability Insurance Cost or Public Liability Insurance for Contractors. This will help clients understand the unique benefits of umbrella coverage.

In our next email, we will share strategies for successfully upselling Commercial Umbrella Liability Insurance to your clients.

Best regards,

[Your Name]

[Your Contact Information]

[Your Company Name]

Email 3 Upselling Commercial Umbrella Liability Insurance

Subject Master the Art of Upselling Commercial Umbrella Liability Insurance

Body

Hi [Recipient's Name],

Now that you’re equipped with the knowledge to explain the value of Commercial Umbrella Liability Insurance, let’s explore effective strategies for upselling this essential coverage.

1. Start with a Needs Assessment

Begin by conducting a thorough needs assessment. Identify areas where the client's current coverage might be lacking and present Commercial Umbrella Liability Insurance as a solution to address these gaps.

2. Leverage Existing Relationships

Utilize your existing relationships with clients. If they trust you with their Professional Indemnity Liability Insurance or Small Business General Liability Insurance Cost, they are more likely to consider your recommendations for additional coverage.

3. Bundle with Other Policies

Offer Commercial Umbrella Liability Insurance as part of a bundled package with other policies like Cyber Liability Insurance for Small Business or Employment Practices Liability Insurance Cost. Bundling can provide better overall protection and potentially reduce costs.

4. Provide Value-Added Information

Offer clients detailed reports or comparisons showing how Commercial Umbrella Liability Insurance can offer more comprehensive coverage compared to their existing policies. For instance, compare it with Errors and Omissions Liability Insurance or Directors and Officers Liability Insurance Cost.

5. Create Urgency

Help clients understand the risks they face without this coverage. Emphasize the potential financial impact of major claims and how Commercial Umbrella Liability Insurance can mitigate these risks.

6. Educate and Inform

Host webinars or create educational materials that explain the benefits and importance of Commercial Umbrella Liability Insurance. Clients who are well-informed are more likely to see the value in upgrading their coverage.

Our next email will focus on overcoming common objections and handling client concerns regarding Commercial Umbrella Liability Insurance.

Best regards,

[Your Name]

[Your Contact Information]

[Your Company Name]

Email 4 Overcoming Objections to Commercial Umbrella Liability Insurance

Subject How to Address Common Objections to Commercial Umbrella Liability Insurance

Body

Hi [Recipient's Name],

Addressing client objections effectively can make a significant difference in your ability to sell Commercial Umbrella Liability Insurance. Here are strategies to handle common concerns

1. Cost Concerns

Clients may worry about the cost of Commercial Umbrella Liability Insurance. Reassure them by comparing it to the potential costs of a major liability claim. Emphasize that this coverage is a cost-effective way to protect their business from potentially devastating financial losses.

2. Confusion About Coverage

Clients might be confused about what Commercial Umbrella Liability Insurance covers. Provide clear, straightforward explanations and use examples to illustrate how it complements their existing policies like Public Liability Insurance for Freelancers or Business Liability Insurance Comparison.

3. Perceived Redundancy

Some clients might feel that Commercial Umbrella Liability Insurance is redundant if they already have adequate coverage. Address this by explaining how umbrella policies provide additional protection beyond the limits of their current policies, offering more comprehensive coverage.

4. Lack of Awareness

Clients may simply be unaware of the benefits of Commercial Umbrella Liability Insurance. Share educational resources and case studies that highlight its importance and benefits. Show them how it can fill gaps in their existing coverage.

5. Misconceptions About Claims

Clients may be concerned that Commercial Umbrella Liability Insurance won’t be necessary if they haven’t had any major claims. Emphasize that it’s a proactive measure designed to protect against unforeseen risks and provide peace of mind.

6. Reinforce the Value

Continually reinforce the value of Commercial Umbrella Liability Insurance by highlighting real-world examples and success stories from other clients. The more they understand the potential risks and benefits, the more likely they are to see its value.

Thank you for your dedication to helping your clients secure their business with the best possible coverage. If you have any questions or need further assistance, feel free to reach out.

Best regards,

[Your Name]

[Your Contact Information]

[Your Company Name]

By utilizing these email templates, you can effectively communicate the benefits of Commercial Umbrella Liability Insurance to your clients and enhance your service offerings. The keywords and target cities like Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines are integrated throughout to ensure relevance and focus on specific areas.

Protect Your Real Estate Business with Commercial Umbrella Liability Insurance

In the dynamic world of real estate, where every transaction involves significant financial and legal implications, protecting your business against unforeseen risks is essential. Commercial Umbrella Liability Insurance offers comprehensive coverage that can safeguard your real estate business from unexpected liabilities that might exceed the limits of your standard policies. This landing page explores the benefits of commercial umbrella liability insurance specifically tailored for real estate professionals and emphasizes why it's a crucial addition to your risk management strategy.

What is Commercial Umbrella Liability Insurance?

Commercial Umbrella Liability Insurance provides additional coverage beyond the limits of your existing policies, such as general liability insurance, professional liability insurance, and cyber liability insurance. It acts as a safety net, offering extra protection when the limits of your primary coverage are reached. This type of insurance is essential for real estate professionals who face a range of potential risks in their daily operations.

Benefits of Commercial Umbrella Liability Insurance for Real Estate Professionals

1. Extended Coverage Limits

In the real estate industry, the stakes are high, and so are the potential liabilities. Commercial Umbrella Liability Insurance extends the coverage limits of your existing policies, including general liability insurance for small businesses and professional liability insurance for consultants. This means that in case of a large claim or lawsuit, your umbrella policy can cover the costs that exceed the limits of your primary insurance policies.

2. Comprehensive Protection

Real estate professionals deal with various risks, from errors and omissions liability to product liability insurance costs. A commercial umbrella policy provides a broader range of coverage, including protection against claims that may not be covered by your standard policies. This includes protection against claims related to public liability insurance for contractors and employment practices liability insurance costs, ensuring that you are fully covered against diverse risks.

3. Peace of Mind

With a commercial umbrella liability insurance policy, you can focus on growing your business without constantly worrying about potential lawsuits or claims. This additional layer of protection offers peace of mind, knowing that your business is shielded from financial ruin due to unforeseen liabilities.

4. Cost-Effective Coverage

Compared to the cost of increasing limits on all your individual policies, commercial umbrella liability insurance offers a cost-effective solution to ensure comprehensive protection. By investing in an umbrella policy, you get substantial additional coverage at a fraction of the cost of increasing the limits on your other policies.

5. Flexibility and Adaptability

As your real estate business grows, your insurance needs may evolve. Commercial umbrella liability insurance is flexible and can adapt to the changing needs of your business. Whether you're expanding into new markets or adding new services, your umbrella policy can provide the necessary coverage to match your growth.

Why Real Estate Professionals in [Target Cities] Need Commercial Umbrella Liability Insurance

Louisville

In Louisville, the real estate market is competitive and growing. With the potential for high-value transactions and diverse property types, having commercial umbrella liability insurance ensures that your business is protected from large-scale claims that may arise from property transactions or other real estate activities.

Grand Rapids

Grand Rapids has a dynamic real estate scene with various commercial and residential properties. The potential for complex transactions and legal issues makes commercial umbrella liability insurance crucial for safeguarding your business against unexpected liabilities.

Oklahoma City

Oklahoma City's real estate market is booming, with new developments and commercial ventures on the rise. For real estate professionals in this thriving market, commercial umbrella liability insurance provides an essential layer of protection against the financial risks associated with large-scale transactions and property management.

Lansing

In Lansing, real estate professionals are involved in a range of property deals, from residential to commercial. Commercial umbrella liability insurance is vital for protecting against the diverse risks associated with these transactions and ensuring that your business is covered beyond the limits of your primary insurance policies.

Des Moines

Des Moines is a growing real estate market with increasing opportunities and potential liabilities. A robust commercial umbrella liability insurance policy offers peace of mind and protection against claims that may exceed the limits of your standard coverage, allowing you to focus on expanding your business.

Types of Coverage Included in a Commercial Umbrella Policy

- General Liability Insurance Provides protection against claims related to bodily injury, property damage, and personal injury.

- Professional Liability Insurance Covers claims arising from errors, omissions, or negligence in the services provided.

- Cyber Liability Insurance Protects against data breaches and cyberattacks.

- Employment Practices Liability Insurance Covers claims related to wrongful termination, discrimination, and harassment.

- Product Liability Insurance Protects against claims related to products sold or used in your real estate business.

How to Get Started

Securing commercial umbrella liability insurance is a straightforward process. To get started, follow these steps

- Assess Your Needs Evaluate the potential risks and liabilities associated with your real estate business.

- Review Your Existing Policies Check the coverage limits of your current general liability insurance, professional liability insurance, and other relevant policies.

- Request a Quote Contact a trusted insurance provider to get a quote for a commercial umbrella liability insurance policy tailored to your business needs.

- Consult with an Expert Schedule a consultation with an insurance expert to discuss your coverage options and ensure you choose the right policy for your business